WELLGROWSHARES CO. is a private investment community created by a group of experience fund manager. Based on our investment & financial experience, we know exactly the best and safest way for money grow.

Our fund managers develops its expertise through an "Absolute Return" approach, with the objective of capital appreciation by taking advantage from opportunities in the markets, and keeping a conservative line in managing risks.

We never put fund in Hyip, forex and many other high risk investment lines

The objective of the fund is to achieve consistent growth regardless of market conditions by investing in the global financial markets using a top-down, macro-economic and valuation asset allocation process.

The fund invests in bonds, equities, commodities, mutual funds, indices, and with a high degree of diversification.

The fund concentrates on achieving absolute returns and does not intend to replicate any particular benchmark or asset allocation weighting.

The fund minimizes risks by using stringent risk management techniques.

OUR PHILOSOPHY

"ABSOLUTE RETURN" approach, the crossroad between Traditional asset management and Alternative asset management

The methodology is based on a TRADITIONAL ASSET MANAGEMENT:

- represented by its direction bias and its thorough fundamental analysis

And relates to the field of ALTERNATIVE ASSET MANAGEMENT :

- as represented by the Risk Management techniques and its asset management objectives.

The Investment Process is founded on a global asset allocation and efficient macro-economic tools.

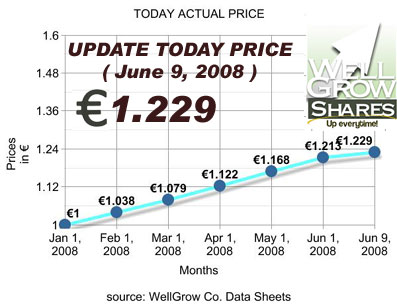

Our Product: WGS - WellGrowShares with a unique system

WGS only released as very limited shares

WGS grows up to 60% per annum

WGS could be bought directly from 'the house' when available

WGS could be bought from 'the market'

WGS could be sold to 'the market' and 'the house'

WGS takeover ( buy & sell ) should be done through 'the house'

INVESTMENT PROCESS

The Investment Management process is a Top-down, macro-economic and valuation driven asset allocation process that relies on FOUR pillars:

- In-depth Macro-Economic analysis

- Tri-dimensional Asset Class and Securities Valuation analysis

- Market Psychology, Flow of Funds and Technical analysis

- Stringent Risk Management techniques

Our fund managers develops its expertise through an "Absolute Return" approach, with the objective of capital appreciation by taking advantage from opportunities in the markets, and keeping a conservative line in managing risks.

We never put fund in Hyip, forex and many other high risk investment lines

The objective of the fund is to achieve consistent growth regardless of market conditions by investing in the global financial markets using a top-down, macro-economic and valuation asset allocation process.

The fund invests in bonds, equities, commodities, mutual funds, indices, and with a high degree of diversification.

The fund concentrates on achieving absolute returns and does not intend to replicate any particular benchmark or asset allocation weighting.

The fund minimizes risks by using stringent risk management techniques.

OUR PHILOSOPHY

"ABSOLUTE RETURN" approach, the crossroad between Traditional asset management and Alternative asset management

The methodology is based on a TRADITIONAL ASSET MANAGEMENT:

- represented by its direction bias and its thorough fundamental analysis

And relates to the field of ALTERNATIVE ASSET MANAGEMENT :

- as represented by the Risk Management techniques and its asset management objectives.

The Investment Process is founded on a global asset allocation and efficient macro-economic tools.

Our Product: WGS - WellGrowShares with a unique system

WGS only released as very limited shares

WGS grows up to 60% per annum

WGS could be bought directly from 'the house' when available

WGS could be bought from 'the market'

WGS could be sold to 'the market' and 'the house'

WGS takeover ( buy & sell ) should be done through 'the house'

INVESTMENT PROCESS

The Investment Management process is a Top-down, macro-economic and valuation driven asset allocation process that relies on FOUR pillars:

- In-depth Macro-Economic analysis

- Tri-dimensional Asset Class and Securities Valuation analysis

- Market Psychology, Flow of Funds and Technical analysis

- Stringent Risk Management techniques